cash conversion cycle deteriorated from 2021 to 2022 and from 2022 to 2023.

#Account receivable turnover in days plus

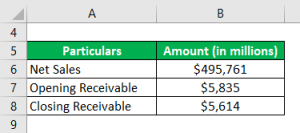

operating cycle deteriorated from 2021 to 2022 and from 2022 to 2023.Īn estimate of the average number of days it takes a company to pay its suppliers equal to the number of days in the period divided by payables turnover ratio for the period.Ī financial metric that measures the length of time required for a company to convert cash invested in its operations to cash received as a result of its operations equal to average inventory processing period plus average receivables collection period minus average payables payment period. number of days of inventory outstanding deteriorated from 2021 to 2022 and from 2022 to 2023.Īn activity ratio equal to the number of days in the period divided by receivables turnover.Įqual to average inventory processing period plus average receivables collection period. This is important because without cash collections, a company will go insolvent and lack the liquidity to pay its short-term bills.An activity ratio equal to the number of days in the period divided by inventory turnover over the period. It tells of a company's short-term financial health.This metric can be used to signal to management to review its outstanding receivables at risk of being uncollected to ensure clients are being monitored and communicated with. Revenue in each period is multiplied by the turnover days and. The AR balance is based on the average number of days in which revenue will be received. In financial modelling, the accounts receivable turnover ratio is used to make balance sheet forecasts. Both define different aspects of your accounts receivable performance, and both need to be tracked and optimized. Accounts Receivable Turnover Ratio 100,000 - 10,000 / (10,000 + 15,000)/2 7.2. A good accounts receivable turnover depends on how quickly a business recovers its dues or, in simple terms how high or low the turnover ratio is. Receivables turnover and days sales outstanding work in tandem. Understanding Receivables Turnover and DSO. This is important because as the average collection period increases, more clients are taking longer to pay. Sometimes, automation of accounts receivable processes might be just what you need to accelerate your cashflow. It tells early signals of bad allowances.This gives deeper insight into what other companies are doing and how a company's operations compare. This is important because all figures needed to calculate the average collection period are available for public companies. It tells how competitors are performing.This is important as strict credit terms may scare clients away on the other hand, credit terms that are too loose may attract customers looking to take advantage of lenient payment terms.

#Account receivable turnover in days full

Until cash has been collected, a company is yet to reap the full benefit of the transaction. This bodes very well for the cash flow and personal goals in the small doctor’s office. Accounts Receivable Turnover Ratio 100,000 - 10,000 / (10,000 + 15,000)/2 7.2.

This is important because a credit sale is not fully completed until the company has been paid. The accounts receivable turnover rate is 10, which means the average accounts receivable is collected in 36.5 days (10 of 365 days).

As such, they indicate their ability to pay off their short-term debts without the need to rely on additional cash flows. AR is listed on corporations' balance sheets as current assets and measures their liquidity. Companies normally make these sales to their customers on credit. H s vng quay khon phi thu l mt cch tnh trong k ton kim tra hiu qu ca cng ty trong vic thu hi khon phi.

0 kommentar(er)

0 kommentar(er)